The Federal Government has unveiled a new tax credit initiative targeting roof installations to encourage homeowners to embrace energy efficiency.

TRAVERSE CITY, MI, US, August 28, 2023/EINPresswire.com/ — In a strategic move to encourage homeowners to embrace energy-efficient and sustainable living, the Federal Government has unveiled a new tax credit initiative targeting roof installations.

For the years 2023 and 2024, homeowners who opt for qualified energy-efficient roofing systems can avail themselves of substantial tax benefits.

Key Highlights of the new roof tax credit for 2023 and 2024.

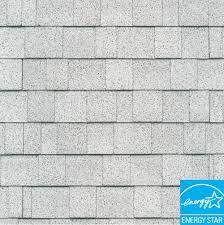

Eligible Roofing Material: The tax credit is exclusive to “Energy Star” certified roofing products, which significantly reduce the home’s heat gain, thereby cutting cooling costs.

Tax Credit Amount: Homeowners can claim a tax credit amounting to 30% of the roofing material cost, with a cap of $1200. This excludes installation costs.

Residential Provisions: The incentive is valid for primary residences, with new constructions and rental homes being exempted. Both first-time installations and replacements qualify.

Sustainable Impact: Beyond the financial advantages, these roofing materials are designed to reflect more sunlight and absorb less heat, reducing the strain on the environment and lessening the urban heat island effect.

Extended Roof Life: The qualifying roofing products are energy efficient and increase the roof’s longevity, offering homeowners long-term savings.

Application Process: To claim the credit, homeowners must fill out IRS Form 5695 and include the credit amount in their yearly tax returns.

This tax credit initiative stands as a testament to the government’s commitment to advancing energy-efficient practices in the residential sector.

With the dual benefits of reduced energy costs and a minimized carbon footprint, homeowners are poised to embrace a sustainable future.

To learn more about the new roof tax credit for 2023 and 2024, visit https://nationaltaxreports.com/energy-star-roof-tax-credit/

Frank Ellis

Harbor Financial

+1 231-480-4086

email us here

Visit us on social media:

LinkedIn

![]()

Article originally published on www.einpresswire.com as New Roof Installations Now Come with Attractive Tax Credits in 2023 and 2024

The post New Roof Installations Now Come with Attractive Tax Credits in 2023 and 2024 first appeared on Social Gov.

originally published at Business - Social Gov